The Banking on Climate Chaos report reveals that the world’s biggest banks continued to pour billions into fossil fuel expansion in 2021.

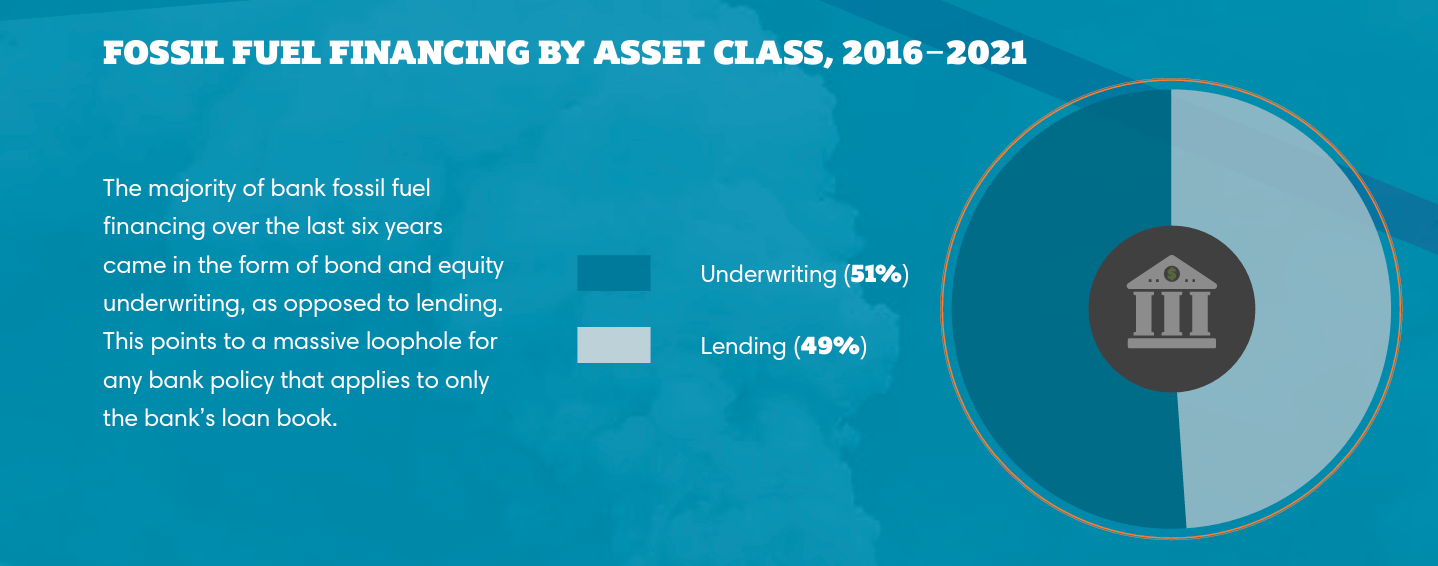

This underscores the stark disparity between public climate commitments being made by the world’s largest banks, versus the reality of their largely business-as-usual financing to the fossil fuel industry. The report adds up lending, and underwriting of debt and equity issuances from the world’s 60 biggest banks for the fossil fuel sector as a whole, as well as for top expanders of the fossil fuel industry and top companies in specific sectors.

The report documents that in the six years since the Paris Agreement was adopted, the world’s 60 largest private banks financed fossil fuels with USD $4.6 trillion, with $742 billion in 2021 alone. 2021 fossil fuel financing numbers remained above 2016 levels, when the Paris Agreement was signed.

The 60 banks profiled in the report funneled $185.5 billion just last year into the 100 companies doing the most to expand the fossil fuel sector. The report also highlights that in 2021, fossil fuel lending and underwriting continued to drive shocking human rights abuses, particularly in Indigenous, Black, and Brown communities.

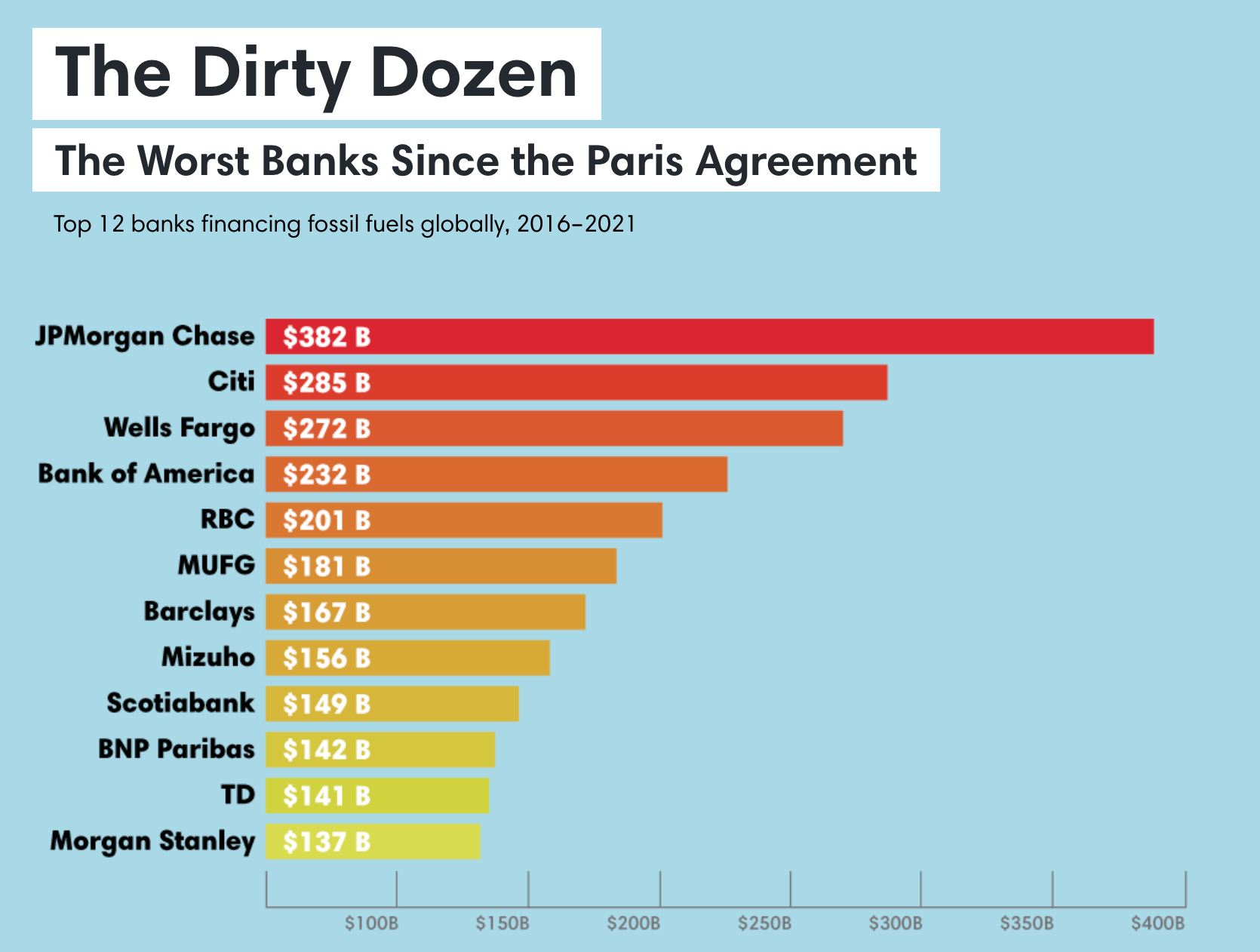

The report shows that overall fossil fuel financing remains dominated by four U.S. banks, with JPMorgan Chase, Citi, Wells Fargo, and Bank of America together accounting for one quarter of all fossil fuel financing identified over the last six years. JPMorgan Chase remains the world’s worst funder of climate chaos, while JPMorgan Chase, Wells Fargo, Mizuho, MUFG, and all five Canadian banks were among those that increased their fossil financing from 2020 to 2021. As global oil and gas markets are rocked by Russia’s invasion of Ukraine, the data reveal JPMorgan Chase to be the biggest banker covered in this report for Russian state energy giant Gazprom, both in terms of 2016-2021 totals and when looking only at last year. JPMorgan Chase provided Gazprom with $1.1 billion in fossil fuel financing in 2021.

Banking on Climate Chaos was authored by Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil Change International, Reclaim Finance, Sierra Club, and Urgewald, and is endorsed by over 500 organizations from more than 50 countries around the world.